This is a short follow-on to our earlier note, “The Shadow Side of Shiny Missions.”

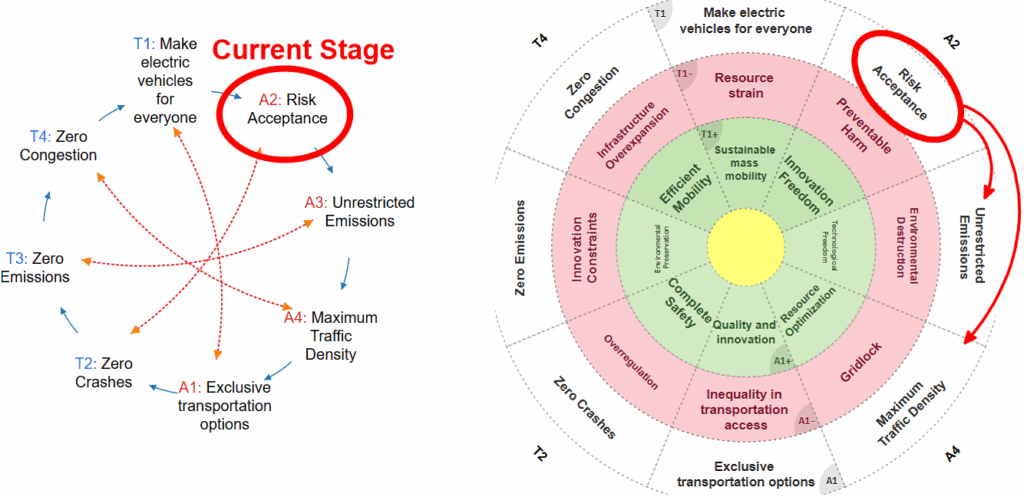

We translated GM’s mission (“Zero Crashes, Zero Emissions, Zero Congestion” + “EVs for everyone”) into a dialectical mission wheel—a causal map that shows both the bright promises and their shadow trade-offs. Then we asked AI to place GM on that wheel, predict the next turn, and sketch likely effects on value and relationships.

Where GM sits now

GM appears to be in a corrective/containment turn of the cycle—moving from “innovation freedom” back toward quality, safety, and resource optimization. Triggers include the Cruise robotaxi setback (safety credibility) and a slower-than-hoped EV ramp (cost/demand alignment). Translation: less headline-grabbing moonshots; more process discipline.

What’s likely next

Expect a clockwise move toward the green core of the wheel:

- Tighten safety governance (measured AV relaunch, more transparency).

- Simplify and de-risk EV rollout (fewer trims, cost-down batteries, stronger charging partnerships, focus on profitable nameplates/fleets).

- Operational optimization (smoother Ultium manufacturing cadence, supplier coordination).

For a more accurate modelling (that considers external factors) see Matching Ambitions with Realities

Why this matters (value & performance)

- Stock profile: Near-term upside is supported more by capital returns (dividends/buybacks) and cost execution than by “tech multiple” narratives. Clean execution could grind the multiple higher; fresh AV mishaps or EV demand air-pockets cap it.

- Public & regulators: Rebuild phase. Expect friendlier oversight once GM shows safety-first behavior; reputational recovery comes before re-acceleration.

- Partners & dealers: Fewer speculative JVs; tighter, more reliable commitments. Dealers get steadier incentives as the EV cadence normalizes.

- Competitors: While GM consolidates, rivals may gain share in robotaxis and specific EV niches; GM trades absolute growth for durable, lower-risk progress.

The bigger lesson: why read a Mission Wheel?

A mission sounds linear; reality is dialectical. Mapping a mission into a wheel:

- surfaces trade-offs (e.g., “Zero Emissions” ↔ resource strain; “Zero Crashes” ↔ over-regulation risks);

- shows likely next moves as firms oscillate between ambition and constraints;

- turns vision into testable signals (what to watch: safety disclosures, model trims, battery costs, JV terms, regulator tone).

For leaders: it’s a strategy early-warning system—see where your bright promise creates its own headwinds and plan the next turn intentionally.

For investors/partners: it’s a pragmatic forecast tool—track which quadrant a company occupies today to infer execution focus, risk profile, and valuation drivers tomorrow.

If you want us to map your company’s mission into a wheel, we’ll show the glow and the shadow—and what that implies for the next five quarters.