Since everything moves in cycles, can we forecast the future from those cycles’ definitions?

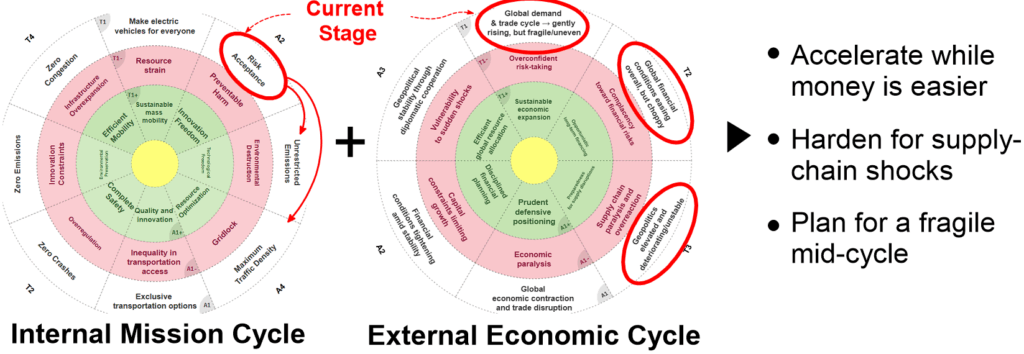

In this experiment we used two wheels: one built from a company’s ambitions (GM’s mission as an example) and another from the external economic cycle.

External factors used:

- T1: Global demand & trade cycle → gently rising, but fragile/uneven

- T2: Global financial conditions → easing overall, but choppy

- T3: Geopolitics → elevated and deteriorating/unstable

From T1–T3, AI generated an External Economic Wheel. We combined it with GM’s Internal Mission Wheel (this could be any firm’s OKRs) and asked for actionable guidance.

What we found

- Dual-cycle analysis improves timing.

The internal wheel predicts where a company wants to go; the external one shows when the environment helps or hinders.

For GM, this means: mission-driven expansion into EVs aligns with easier credit conditions — but collides with unstable supply chains and geopolitical risk. - The overlap defines the near-term performance zone.

The external environment currently sits in a fragile mid-cycle recovery: mild growth, softer rates, but persistent volatility.

Combined with GM’s internal position (“Risk Acceptance”), this suggests short-term upside with elevated execution risk — the sweet spot for cautious acceleration.

Generalizing Beyond GM

Any organization can build:

- an Internal Wheel from mission, OKRs, or value statements; and

- an External Wheel from market, financial, or geopolitical indicators.

Where they align, strategy compounds. Where they diverge, resilience planning dominates.